OWNERSHIP/

Blue Horseshoe loves Anacott Steel

Track insiders, activists and hedge funds.

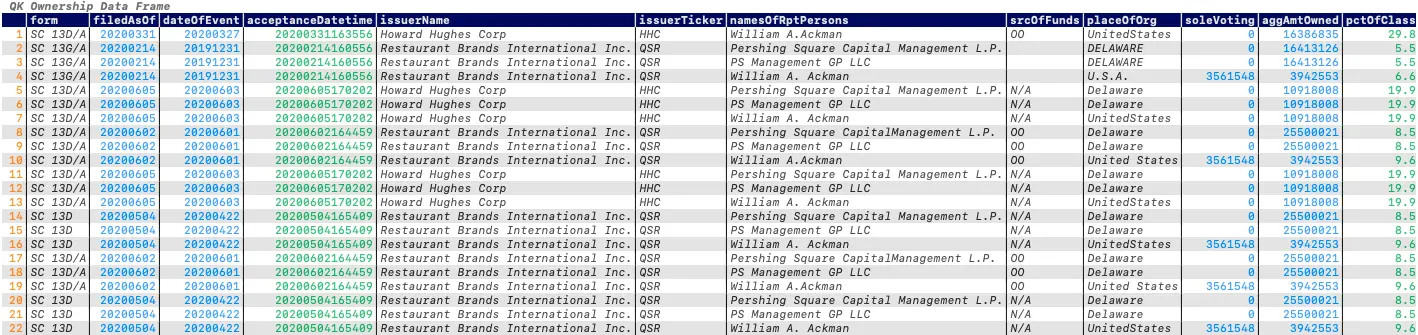

Pershing Square Activist (13D + 13G) : qk_beneficial(qk_search_mgr("pershing"), yyyyqq=202004, qtrs=4)

Aggregate current and historic market sentiment by combining positions of large stakeholders, firms with outsized influence, those accumulating control and even the intentions of the CEOs across all public companies and private shareholders.

Public ownership expertise

spanning 30+ years.

Between the founders and advisors we bring decades of experience at the highest levels of investing. We

know the speed and breadth quants want, granular perfection that portfolio managers demand, the breadth needed by CFOs and most importantly, how to make getting the data into your workflow effortless.

Five Slices of Ownership

Institutional

Some of the most anticipated filings every quarter comes from the 7,000 institutional funds who report for more than 10,000 sub-managers. Disclosing

positions held at quarter end, the data hints at current positioning and past performance. Signaling cyclical investment trends and

stocks that are in or out of favor, we deliver parsed, mapped and corrected data within minutes of filing. Our data extends well beyond what is filed

to include details on position changes, sector breakdowns, instrument classes and even how sub-manager voting rights change over time. Our data

is used to discover investment shifts at the market level and even structural changes in the funds themselves.

Purchase: api, bulk, qk one, qk complete

Issuer

Often investors look to see institutional ownership for individual issuers. We refer to that as Holders - and it is a quick way to see all the filers

for a public company in one dataset. The same level of rigor that is used to generate our institutional data is applied to company view - meaning you immediately see

what firms have positions, but easily discover which have increased/decreased their holdings or exited a position. We keep track of instruments, portfolio

contribution and amended reporting as well. All the while, applying corrections when needed and delivering these views throughout the day.

Purchase: api, bulk, qk complete

Activist + Beneficial

Large shareholders and investors looking to take control of a company. Notoriously difficult to extract from the original filings, we have the full

history of what the SEC® refers to as Beneficial investors. These are also known as block holders, as they own or control more than

5% of a company. Knowing who can effect change on a company - precisely when the line between passive and active is crossed is where market moving

news starts.

Purchase: api, bulk, qk complete

Insider

Insiders are who you think they are. Founders, executives and board members of public companies that have equity interest in the form of shares,

restricted stock units or other derivatives. Form 4s are the most common type of filing, yet their regularity is critical to float as well as potential

insights into the future of a firm. Many subtleties exist in this filing and keeping track of footnotes to process makes a difference. We

extract, map and tabularize the data to make analysis easy and immediate.

Purchase: api, bulk, qk complete

Mutual Funds

Mutual funds, the relatively passive investors of the market that make up the majority of ownership, report detailed holdings of both public and

non-public securities. We extract, map, and tabularize to once again enable quick and easy discovery of both performance and holdings across thousands of

funds reporting quarterly.

Coming Soon: api, bulk, qk complete